The Main Principles Of Forex Spread Betting

Wiki Article

Excitement About Forex Spread Betting

Table of ContentsFacts About Forex Spread Betting RevealedHow Forex Spread Betting can Save You Time, Stress, and Money.The Buzz on Forex Spread BettingExamine This Report on Forex Spread BettingThe Best Strategy To Use For Forex Spread BettingForex Spread Betting - QuestionsForex Spread Betting Fundamentals Explained

They use reasonably tight spreads but go through overnight funding. This is a cost that you pay to hold a trading position over night on leveraged trades. It is effectively a passion payment to cover the cost of the leverage that you are making use of. Daily moneyed wagers are usually used for temporary placements due to the influence of these over night fees.

You determine to bet 10 per point. The share rate does without a doubt rally, to 170. Once more, a one-point spread applies, so the sell price is 170.

Rumored Buzz on Forex Spread Betting

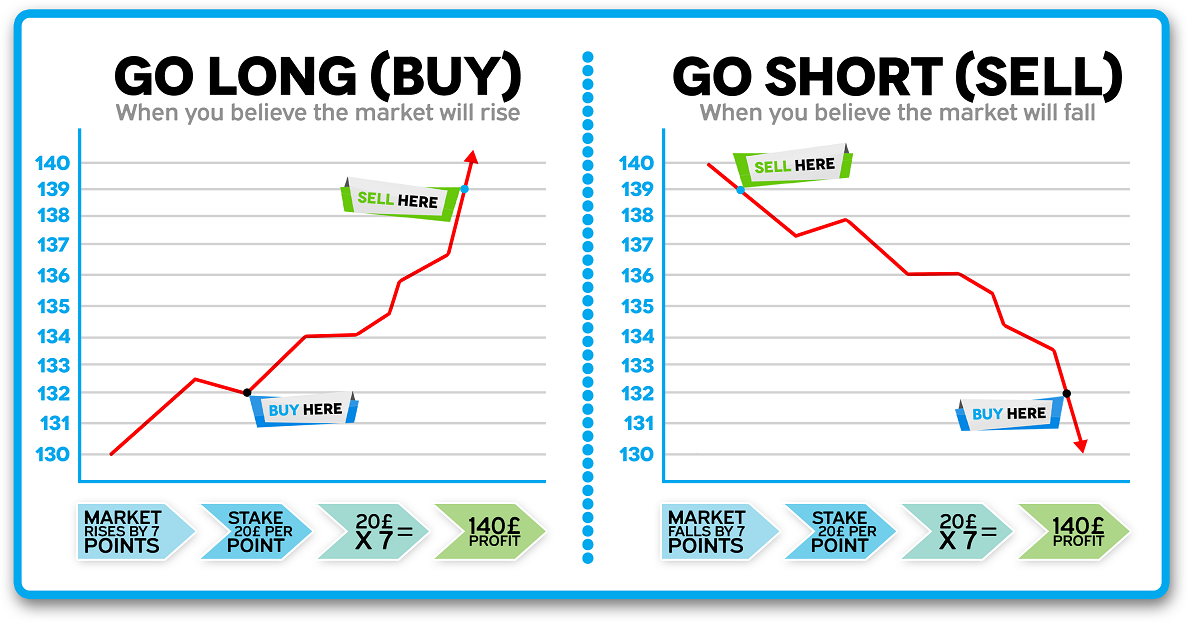

As we have seen, among the advantages of spread wagering is that you can amplify the influence of your bet through utilize. To put it simply, you just need to deposit a little portion of the overall value of any kind of trade. This is recognized as the margin. For instance, if the margin requirement for a profession is 20 percent, after that you would just need 20 per cent of the complete value of the sell your account to open the position.Below is an instance from the broker City Index, which discusses how leverage functions when you spread out bet on stocks. The same concepts relate to all various other monetary instruments that you spread bet on. Number 3: Example of exactly how take advantage of works in spread betting, Source: City Index Number 3 details the enchanting effect of take advantage of in magnifying your resources.

You decide to acquire 1000 shares in ABC plc at a price of 5 each in the belief that the firm's earnings will soar. If you simply bought the shares straight on the supply market, the overall expense would be 5000 (1000 shares x 5 per share). You might attain the very same direct exposure by taking out a spread bet of 10 per point on the very same firm, and you would only have to offer a deposit, or margin, of 1000 due to the fact that the broker is providing you utilize of 5:1.

What Does Forex Spread Betting Do?

You need to always see to it the funds in your account suffice to cover any type of losses from existing trades. Or else, there is a threat that the broker might merely shut your positions, leaving you with losses. The benefits of spread wagering consist of: There is no stamp duty to pay, as well as any type of earnings you make are tax-free. forex spread betting.

It is really simple to trade through an on the internet broker, either in your residence or on the go. You can bet that the price of an instrument will increase or fall.

The Ultimate Guide To Forex Spread Betting

Spread banking on shares grants capitalists no entitlement to returns or the various other legal rights delighted in by shareholders. Your losses are not restricted to your initial stake. If you acquire 5000 of shares, for instance, the most you can lose is that 5000. By contrast, with spread betting you can lose two, three or even 10 times your original stake within a few minutes as an effect of leverage.Although utilize indicates you can trade a large amount with a relatively little amount, spread betting can be remarkably outstanding extensive. That is because you constantly need to maintain a huge amount on get to cover any losses and also prevent a margin telephone call or, worse still, have the broker close your account.

While this develops successful opportunities, it can likewise show unsafe, with prices relocating greatly in either direction. You are getting in into a contract with the broker as well as there is always the danger that the various other event to the agreement can go bust or, in the instance of an unregulated next broker, just renege on the offer.

The 8-Minute Rule for Forex Spread Betting

Both make usage of utilize and allow financiers to take advantage of movements in the rates of a wide variety of financial instruments. You can utilize either spread wagering or CFDs to bet that a product will increase or fall in worth. The key difference in between both products is that revenues from spread betting are without tax obligation, while benefit from CFDs are subject to capital gains tax in the UK.Additionally, while you do not pay a payment on spread wagering, brokers might bill a compensation to trade in CFDs. Provided the dangers associated with spread wagering, it is vital that you understand the procedures you can require to reduce any losses. You can protect versus the danger of shedding greater than your deposit in a profession by establishing an automated quit, or restriction, to define the degree at which you would certainly like your profession to be closed.

Spread wagering on shares gives financiers no entitlement to returns or the other civil liberties taken pleasure in by investors. Your losses are not limited to your original stake. If you buy 5000 of shares, as an example, the most you can shed is that 5000. By comparison, with spread wagering you can shed two, 3 or also ten times your original stake within a couple of minutes therefore of take advantage of.

7 Simple Techniques For Forex Spread Betting

Although leverage means you can trade a huge amount with a relatively little amount, spread betting can be remarkably capital extensive. That is due to the fact that you always require to maintain a huge amount on book to cover any type of losses and prevent a margin phone call or, even worse still, have the broker close your account.Spread-betting markets can be very unstable. While this creates successful opportunities, it can additionally confirm harmful, with costs relocating dramatically in either instructions. This can cause considerable losses collecting over a brief period. You are participating in a contract with the broker and also there is always the risk that the various other celebration to this contact form the agreement might fold or, in the case of an unregulated broker, just break the deal.

Some Of Forex Spread Betting

In addition, while you do not pay a payment on spread wagering, brokers may charge a compensation to trade in CFDs. Given the risks associated with spread wagering, it is crucial that you know the steps you can require to minimize any type of losses. You can guard versus the risk of losing greater than your deposit in a profession by setting an automated stop, or limit, to specify the level at which you would certainly like your trade to be closed.Report this wiki page